Inflation Surges in China as Lunar New Year Spending Boosts Economic Activity

A Temporary Boost in Spending

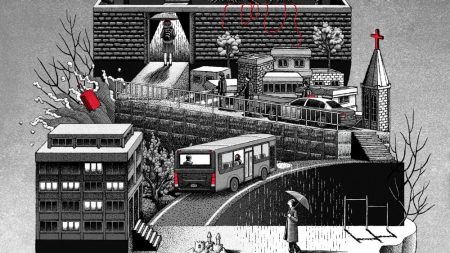

Inflation in China saw a notable increase last month, according to official data released on Sunday, as the Lunar New Year holiday spurred higher spending across the country. The rise in consumer activity comes after months of sluggish demand, which has been further compounded by a struggling property market and rising local government debt. These factors have weighed heavily on China’s economic growth, making the recent uptick in inflation a significant, albeit temporary, development. The Lunar New Year, one of China’s most significant holidays, typically sees millions of people traveling to their hometowns, celebrating with festive meals, and engaging in increased consumer spending. This year, the holiday began earlier than usual, contributing to the surge in prices for goods and services associated with the festivities.

The Rise in Consumer Price Index (CPI)

The National Bureau of Statistics reported that the Consumer Price Index (CPI), a key indicator of inflation, rose by 0.5% last month, marking the highest increase since August 2023, when CPI stood at 0.6%. This surge exceeded the 0.4% rise predicted by Bloomberg analysts and reflects the impact of holiday-related spending. Food prices, in particular, played a significant role in driving the increase, with fresh vegetables seeing a 2.4% year-on-year rise, while pork prices jumped by 13.8%. According to Goldman Sachs analyst Xinquan Chen, the boost in prices was primarily due to higher food prices and increased demand for tourism-related services during the earlier-than-usual Lunar New Year. However, Chen also cautioned that this upward trend is likely to reverse in February as the seasonal demand fades and economic activity returns to normal.

The Challenges of Deflation and Sluggish Demand

China has been grappling with deflationary pressures for some time, with prices falling at the sharpest rate in 14 years in January 2024. This marked the end of a four-month period of deflation, during which inflation remained below 0.5% for nine months of the year. While deflation may seem beneficial at first glance, it poses significant risks to the broader economy. Consumers often delay purchases in anticipation of further price drops, leading to reduced demand. This, in turn, forces businesses to cut production, freeze hiring, or even lay off workers. Companies may also be forced to discount their existing stock, which can harm profitability without reducing costs. The combination of these factors creates a challenging environment for economic growth and stability.

Government Measures to Stimulate the Economy

In response to the economic slowdown, the Chinese government has implemented a range of measures to boost consumption and stabilize growth. Last year, policymakers introduced cuts in interest rates and lifted restrictions on homebuying to encourage spending and investment. More recently, in January, the government expanded a subsidy scheme for common household items, including water purifiers, laptops, and electric vehicles. These subsidies are part of broader efforts to stimulate demand and support domestic industries. The impact of these measures was evident during the Lunar New Year holiday, as sales of household appliances and communication equipment at key monitored retail enterprises saw a year-on-year increase of over 10%, according to the Chinese commerce ministry.

The Broader Economic Implications

While the Lunar New Year holiday provided a much-needed boost to inflation and consumer spending, the underlying challenges facing China’s economy remain significant. The temporary surge in demand during the holiday period is unlikely to sustain long-term growth, especially as deflationary pressures continue to loom. The property market remains a key area of concern, with slowing growth and rising debt levels posing risks to financial stability. Additionally, the global economic slowdown and weak external demand have further compounded the challenges facing Chinese exporters. Against this backdrop, the government’s measures to stimulate consumption and support domestic industries will be crucial in navigating the current economic landscape.

Looking Ahead: The Road to Sustainable Growth

As China seeks to achieve sustainable economic growth, addressing the root causes of sluggish demand and deflation will be critical. While the Lunar New Year holiday provided a short-term injection of activity, the government will need to continue implementing targeted measures to bolster consumption and investment. Expanding subsidy schemes, reducing bureaucratic hurdles, and encouraging innovation in key sectors could help drive long-term growth. Additionally, policymakers must remain vigilant in managing local government debt and stabilizing the property market to prevent further economic disruptions. By taking a proactive and multifaceted approach, China can work towards building a more resilient and balanced economy capable of withstanding both domestic and global challenges.