Trump’s Shift on Interest Rates: A Change in Tune?

A Surprising Alignment with the Federal Reserve

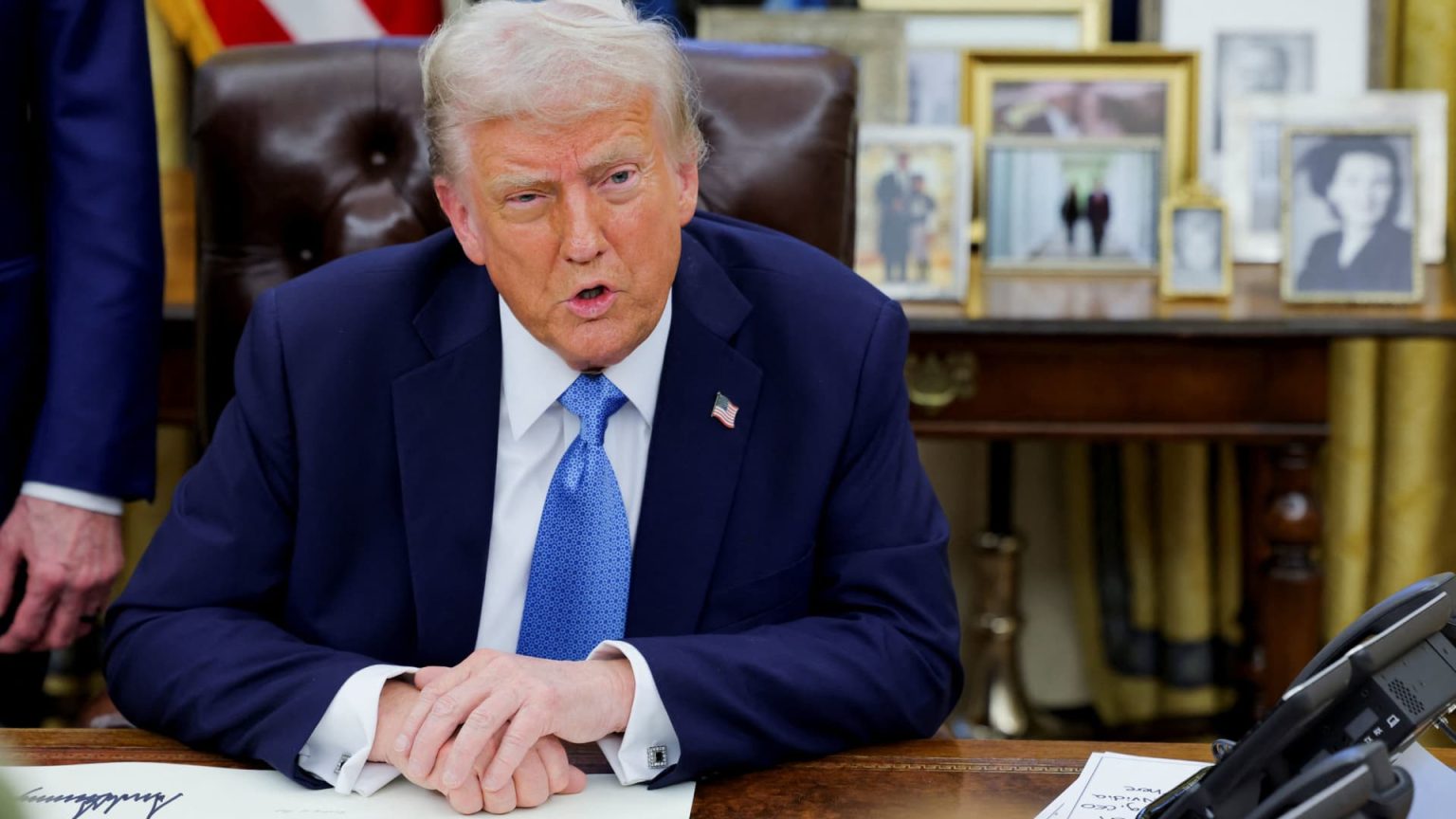

In an unexpected turn of events, President Donald Trump expressed agreement with the Federal Reserve’s decision to maintain interest rates within the range of 4.25% to 4.5%. This stance marked a significant departure from his earlier demands for immediate rate cuts. Trump’s approval of the Fed’s decision was revealed during a recent exchange with reporters, where he stated that holding the rates at their current level was prudent. This aligns with the central bank’s strategy, which has been cautious in its approach to monetary policy adjustments.

A Contrast to Previous Stances

Trump’s current position contrasts sharply with his remarks at the World Economic Forum in Davos, Switzerland, where he asserted his intention to demand an immediate reduction in interest rates. This shift in rhetoric suggests a possible recognition of the Fed’s autonomy and the complexities of economic policymaking. Despite his earlier criticism of Fed Chairman Jerome Powell, Trump’s recent comments indicate a temporary alignment with the Fed’s cautious approach.

The Federal Reserve’s Policy Outlook

The Federal Reserve, under Chairman Jerome Powell, has been deliberating the timing of potential rate adjustments. Powell emphasized during a recent news conference that the Fed is in no rush to lower rates further, following a series of cuts in late 2024. This stance reflects the Fed’s careful balance between supporting economic growth and maintaining control over inflation. Markets anticipate that any potential rate cuts may not occur until June, indicating a wait-and-see approach as economic data unfolds.

Economic Implications of New Tariffs

The complexity of the Fed’s decision-making process was further compounded by President Trump’s announcement of aggressive tariffs against major trading partners, including Canada, Mexico, and China. Economists have raised concerns that these tariffs could lead to increased prices, countering recent signs of easing inflation. Such measures could introduce new variables into the economic equation, potentially complicating the Fed’s efforts to maintain stable monetary policy.

Market Reactions and Expectations

Market expectations for future rate changes remain subdued, with anticipation building around the Fed’s potential actions in the coming months. The central bank’s commitment to data-driven decisions suggests that any policy shifts will be influenced by emerging economic indicators. As the global trade landscape continues to evolve, the interplay between tariffs, inflation, and interest rates will be closely monitored by both policymakers and market participants.

Balancing Economic Policies

In conclusion, President Trump’s recent stance on interest rates presents a nuanced shift in his economic policy approach. While the alignment with the Fed’s decision may indicate a strategic pivot, the introduction of new tariffs adds a layer of complexity to the economic environment. The balance between supporting growth and managing inflation will remain a critical challenge for both the administration and the Federal Reserve. As the situation continues to unfold, the interplay between these policies will shape the economic trajectory in the months to come.