Summarize and humanize this content to 2000 words in 6 paragraphs in English

The fights have been the same for years: Pepsi wrestles with Coke; Verizon tangles with T-Mobile; and Fox News jousts with CNN and MSNBC.

In recent months, however, Fox Corp. has been working to put its much-talked-about cable-news outlet on a different battlefield.

Sales executives from the company are making the case to top media-buying agencies that in the streaming era, Fox News Channel offers the large, live audiences that advertisers historically got from CBS, NBC and ABC, but which are no longer guaranteed now that consumers watch their favorite TV series on broadband outlets at times of their own choosing. The Fox sales pitch comes in the weeks leading to the “upfront,” when U.S. TV companies try to sell the bulk of their commercial inventory ahead of their next programming cycle. Unlike last year, Fox Corp. has no immediate Super Bowl broadcast to help buoy sales, and, like its media rivals, faces market uncertainties due to the Trump administration’s current efforts to levy tariffs.

Fox News rates are “cheaper than broadcast prime, but we have the same scale, the same reach, and high duplication of their audience,” says Trey Gargano, executive vice president of advertising sales for Fox News, during a recent interview. “I don’t think there’s anything else like it in the marketplace,” he adds.

The aggressive maneuver comes as advertisers are starting to show new interest in news overall. The pool of marketers that feel comfortable with news can be limited, particularly as marketers seek to stay away from programming that can strike a nerve with a polarized American audience. News tends to be fueled by commercials from pharmaceutical manufacturers, auto marketers and financial-services companies. Big makers of popular household goods have tended to stay away, according to buyers.

Advertisers seem to be exploring news more than has been the norm, says Suzanne Irving, president of integrated investment and client solutions at OMD, a media buying agency that is part of Omnicom Group. “In the past, it was a hard line — stay away from it,” she says, but “I think what you’re seeing now is there is more a kind of nuanced approach.”

With more consumers choosing to stream traditional programming, live news — meant to be consumed the minute it airs — may have new appeal for the portion of Madison Avenue that is less worried about such an environment. NBCUniversal’s pitch for news programming includes research showing how viewers are more likely to make purchases. More news outlets are open to programmatic ad sales, which can help marketers avoid tough topics and hot talk. CNN, which is on the hunt for a new head of sales, could pitch advertisers on an expected suite of new digital products, while MSNBC may tout a recalibrated programming lineup that gives more screen time to former Biden White House counselor Jen Psaki.

Only Fox News, however, has seen a dynamic surge in audience following the 2024 presidential election. Fox News’ total day audience hiked 48% in the first three months of this year, according to data from Nielsen, while viewership among audiences ages 25 to 54 — the demographic most coveted by advertisers in news programming — rose 58%. The broadcast networks are likely to focus on their ability to snare a younger cohort of viewers between 18 and 49, and to promote their news programming as a place that avoids some of the pointed debate that can be an element of many cable offerings.

Fox News’ ratings may be boosting perceptions on Wall Street. “Fox News is experiencing a historically high share of cable news ratings, has attracted over 100 new blue-chip advertisers, is likely permanently gaining share from cable general entertainment channels’ ad budgets, and we think will print an upside surprise relative to expectations,” said Alan Gould of Loop Capital in a recent research note.

This isn’t the first time media executives have heard such patter from Fox News. The network for months has positioned Greg Gutfeld’s 10 p.m. program against late-night fare from Jimmy Fallon, Jimmy Kimmel and Stephen Colbert and set Harris Faulkner’s mid-afternoon shows against programs such as “The View.”

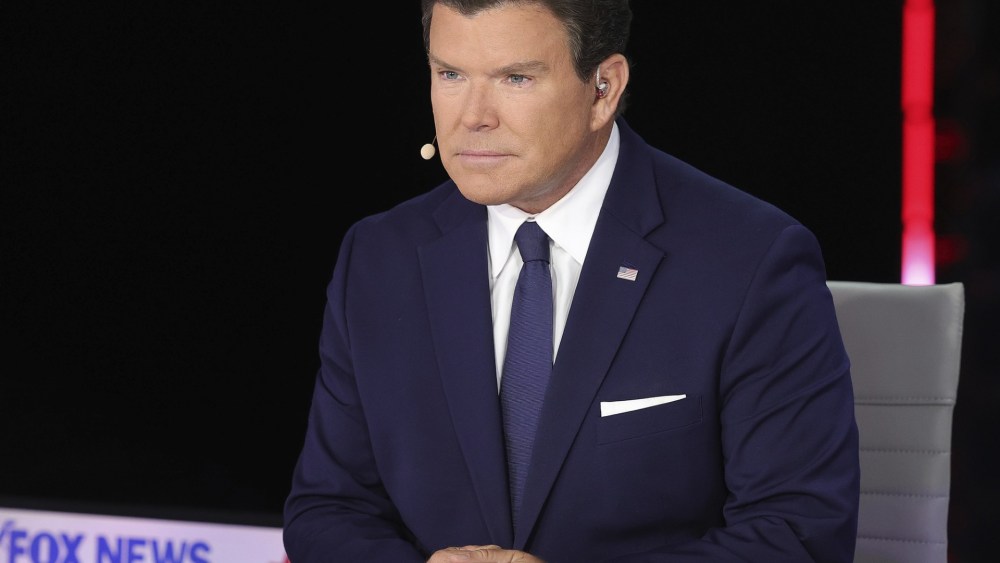

Now there’s a move to expand. In recent comments to investors, Fox Corp. CEO Lachlan Murdoch described Fox News Channel as a “fifth broadcast network.” Fox News has compared its most-watched offering, the roundtable show “The Five,” to broadcast mainstays including ABC’s “American Idol” and CBS’ “Survivor” and “The Neighborhood.” Bret Baier’s early-evening “Special Report” has been compared to “CBS Evening News,” which it has beaten in some markets after that program revamped its format. “America’s Newsroom” compares favorably to several programs on the broadcast networks’ mid-morning schedule.

Fox News was once largely judged by the audiences for its primetime opinion lineup. But the broader array of Fox News shows is getting added spotlight.

“Our emphasis is on the entire schedule. The majority of it has millions of people every hour of the day,” says Gargano. “We are not just selling prime. We are selling our network as prime ratings for the majority of the day.”

Media buyers have long received “broadcast replacement” pitches. Last decade, the company once known as Time Warner made a bid for its TNT and TBS cable networks, stocked at the time with original dramas and a late-night show led by Conan O’Brien, to be considered alongside NBC, CBS, ABC and Fox. In 2018, the former Discovery Networks offered to “curate” a schedule across its various networks that would emulate the reach of primetime broadcast. The concept included lifestyle shows from Discovery outlets like Food Network and TLC, and more.

Fox News is pushing the envelope, however, by not relying on scripted or reality programming — a sign of the broader allure of content that can generate significant simultaneous viewing.

Since selling the bulk of its cable and studio assets to Walt Disney Co. in 2019, Fox News’ corporate parent has focused intently on programming that cultivates live viewership. With President Donald Trump in office, Fox News has been buoyed by its ties to the White House — several of its former employees now hold top offices in the Trump administration — as well as its ability to snare newsmakers ranging from White House adviser Elon Musk to astronauts Suni Williams and Butch Wilmore.

“They do have a story,” says one media buying executive of Fox News’ negotiating concept. “In the lead-up to the election, you can see where the usage was and where the viewership was going and where it wasn’t.” Whether the Fox News pitch ultimately scores, say media buyers, hinges on a range of factors, including the economy and what kind of pricing Fox seeks compared to rival outlets.

VIP+ Analysis: The Time Bomb Ticking Beneath the CTV Advertising Boom

Fox News and its two main cable rivals, CNN and MSNBC, all face choppy terrain given the move of viewers from linear to streaming. Fox News, which regularly wins more ad dollars than either of its traditional competitors, is projected to take in $1.19 billion in advertising in 2025, according to Kagan, a research firm that is part of S&P Global Intelligence, compared with $1.23 billion in 2024. The cable-news networks typically see a dip in ad revenue the year following a presidential election, which generates broader viewership.

CNN’s ad sales, meanwhile, are expected to fall to $587.2 million in 2025, according to Kagan, compared with $663.4 million in 2024. MSNBC’s advertising is projected to fall to $699.2 million, according to Kagan, compared with $752.4 million in the prior year.

One broadcast network may be spared from Fox News’ new effort — the one that is owned by its parent company. Fox News and the Fox broadcast outlet don’t air any programming in common, and Gargano notes the two outlets are “collaborative” when it comes to approaching sponsors.