The UK economy has shown a glimmer of hope with a slight expansion in the final quarter of 2023, defying expectations of a contraction. This growth, though modest at 0.1%, has been a crucial factor in averting a technical recession, offering a reprieve for Chancellor Rachel Reeves amidst mounting economic challenges. The unexpected upturn, driven by a stronger-than-anticipated December performance, particularly in sectors like manufacturing and hospitality, provides a slender optimism. However, this growth does little to quell broader concerns about the nation’s economic trajectory, as the year as a whole saw only marginal growth of 0.9%, concentrated primarily in the first half.

Rachel Reeves, marking her 46th birthday, faces significant fiscal pressures, with tax hikes looming large on the horizon. The Office for Budget Responsibility’s (OBR) revised forecasts, indicating a stark downgrade from the initially projected £10 billion fiscal headroom, underscore the gravity of the situation. As debt interest costs soar and global trade tensions escalate, the Chancellor is under intense scrutiny, with critics warning of a potential breach of fiscal rules. Reeves acknowledges the challenges, emphasizing her commitment to investing in economic revival and addressing structural barriers to growth.

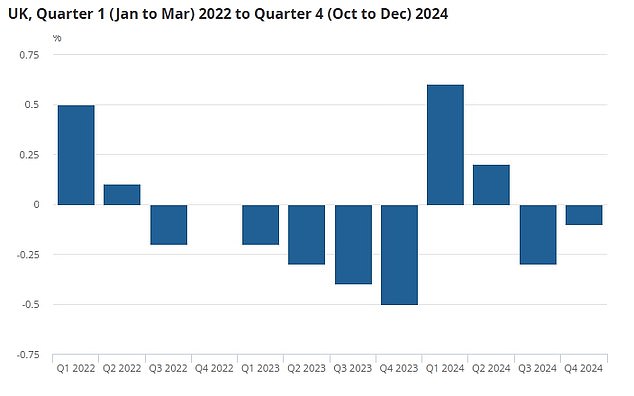

A closer examination reveals that the per capita GDP tells a different story, highlighting a concerning decline. With a 0.1% drop in the final quarter, following a more significant 0.3% fall in the preceding quarter, the per capita GDP has now fallen in two consecutive quarters. This trend, compounded by a notable 0.9% drop in 2023, paints a grim picture of waning living standards. The opposition has seized on this data, criticising Reeves for presiding over a period of economic stagnation that has left households grapple with diminishing purchasing power.

The political landscape is further complicated by criticism from opposition figures, such as Shadow Chancellor Mel Stride, who attributes the economic malaise to Reeves’ fiscal policies. Stride contends that her budget, marked by rising taxes and redundancies, has stifled growth and eroded business confidence. The opposition’s arguments resonate with a public increasingly feeling the pinch of an anemic economy, where the benefits of overall growth have not trickled down to improve individual well-being.

Experts and think-tanks have weighed in, cautioning against complacency despite the avoidance of a technical recession. The Resolution Foundation’s Simon Pittaway highlights the ongoing living standards downturn, with per capita GDP still below pre-pandemic levels, stressing the need for both near-term stimulus and long-term structural reforms. Others, like the TaxPayers’ Alliance, argue for austerity measures such as public sector pay freezes to mitigate the personal recession faced by households. The NIESR think-tank warns of a potential need for fiscal rule flexibility in the face of future economic shocks.

In conclusion, while the UK has narrowly escaped a technical recession, the broader economic narrative remains bleaker. The persistent decline in per capita GDP underscores a deepening living standards crisis. As the nation approaches the next general election, Chancellor Reeves is under pressure to deliver on growth and fiscal stability. The coming months will be pivotal in determining whether the UK can navigate its current economic doldrums and restore growth in living standards, with the political and economic stakes higher than ever.