The U.K.’s ITV has reported strong financial results for 2024, showcasing its resilience and strategic progress despite challenges such as the U.S. actors and writers strikes and weakening demand from traditional broadcasters. The media giant saw an 11% increase in group adjusted EBITA (earnings before interest, taxes, and amortization), reaching £542 million ($700 million), driven by record-breaking profits from ITV Studios and growth in its Media & Entertainment division. This success underscores the company’s ability to navigate the rapidly evolving media landscape, as highlighted by Carolyn McCall, ITV’s chief executive, who noted the significant progress made under the company’s “More than TV” strategy.

Despite these positive indicators, ITV’s total group revenue declined by 3% to $5.34 billion, reflecting a 6% drop in ITV Studios revenue, which was offset by advertising growth. Group external revenue also fell by 4% to $4.51 billion. However, the company’s streaming platform, ITVX, emerged as a standout performer, with digital viewing increasing by 12% and digital advertising revenue surging by 15% in 2024. ITVX has been the fastest-growing streaming platform in the U.K. over the past two years, delivering returns ahead of schedule. The platform’s success contributed to a 22% rise in Media & Entertainment (M&E) profits, which reached approximately $322 million. Notably, ITV revealed that incremental digital revenues outpaced ITVX costs in 2024, achieving this milestone two years earlier than expected. By the end of 2025, the company expects to have fully recouped its cumulative investment in ITVX, much sooner than anticipated.

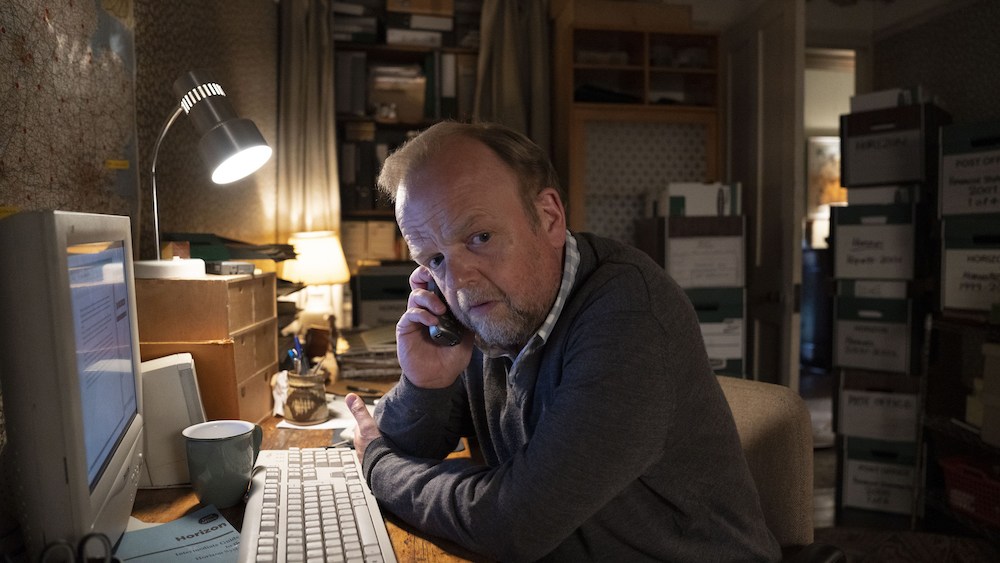

ITV Studios, while experiencing a 6% revenue decline to $2.63 billion, demonstrated its ability to deliver high-quality content with a 5% increase in adjusted EBITA to $386 million and an improved margin of 14.7%. The studio produced several major successes in 2024, including “Mr Bates,” the most-watched drama in the U.K., and “Fool Me Once,” one of Netflix’s most popular shows of all time. Additionally, “Rivals” became a breakout hit for Disney+. These achievements highlight ITV Studios’ ability to create compelling content that resonates with audiences across different platforms. The company also made strides in cost efficiency, with its savings program delivering $77.5 million in 2024, exceeding expectations by $12.9 million. Further savings of $38.7 million in non-content costs are expected in 2025, reflecting ITV’s commitment to operational efficiency.

The company’s financial performance was further bolstered by a strong profit-to-cash conversion rate of 83%, with net debt reducing significantly to $5.57 billion from $713 million in 2023. Statutory operating profit rose to $410 million, up from $307 million in 2023, while profit before tax increased to $672 million. These figures demonstrate ITV’s improving financial health and its ability to generate strong cash flows. McCall emphasized that nearly two-thirds of ITV’s revenue now comes from content production and digital sources, a testament to the company’s diversification strategy and its growing resilience in the face of industry challenges.

Looking ahead, ITV expressed optimism about its future prospects, forecasting “good revenue growth” for ITV Studios in 2025, though margins are expected to be slightly lower than in 2024. The company is also investing in new initiatives, such as Zoo 55, a digital studios label launched in January 2025, aimed at driving high-margin growth in the global digital distribution market. Additionally, ITV plans to expand its digital distribution through a new partnership with YouTube and explore new revenue streams beyond advertising. The company has set an ambitious target of achieving at least $967 million in digital revenues by 2026.

In recognition of its strong performance, ITV’s board proposed a final dividend of 3.3p per share, bringing the full-year dividend to 5.0p, totaling around $245 million. McCall underscored ITV’s transformation into a more resilient business, well-positioned to deliver profitable growth, strong cash generation, and attractive returns to shareholders. As the media industry continues to evolve, ITV’s focus on high-quality content, digital innovation, and strategic efficiency places it in a strong position to thrive in the years to come.